The US natural and organic products market is on course to deliver 9.5% growth in 2020 making the industry worth $252 billion, thanks to surging consumer demand fuelled by the Covid-19 pandemic.

The figures were captured in a keynote presentation at the launch event of Spark Change, New Hope Network’s new virtual event series.

In their joint-presentation The State of Natural & Organic: How Will We Spark Change? New Hope’s Carlotta Mast and Nick McCoy of Whipstitch Capital reveal the latest headline figures, review the impacts of Covid-19 and explain why now is the time industry actors to make “bold moves”.

Breaking the $250 billion barrier

Sharing the latest market data and consumer research Mast and McCoy showed that the US natural and organic market is projected to grow 9.5% in 2020, to be worth $252 billion. The largest two segments are Natural and Organic Food & Beverages and Functional Food & Beverages, accounting for 38% and 31% of total market share respectively, followed by Supplements (21%) and Natural Living (10%). Following four of five years of steady single digit growth, the supplements category takes off in 2020 (up 12% to be worth $54 billion).

Reading retail

The pandemic has changed shopping habits, temporarily at least, accelerating the growth in e-commerce (+50% in 2020). New Hope’s Nutrition Business Journal predicts a doubling of natural and organic e-commerce sales between 2018 and 2023 (from 4-8% total share of retail). Mass market sales continue to dominate in the natural and organic products sector. Mass retail took 59% total market share in 2018 (with natural and specialty retailing at 26%). The natural channel is predicted to lose some share in the coming few years (down to 22% in 2023).

Big up the brands

Fresh data from market research specialist SPINS suggests that consumers have displayed loyalty to branded food products during the pandemic, despite the threat to income and job security. Whilst both private label and brands benefited from the so-called ‘pantry loading’ (less kindly known as panic buying) phase of the Covid crisis, private label has consistently declined since March, and particularly in June and July.

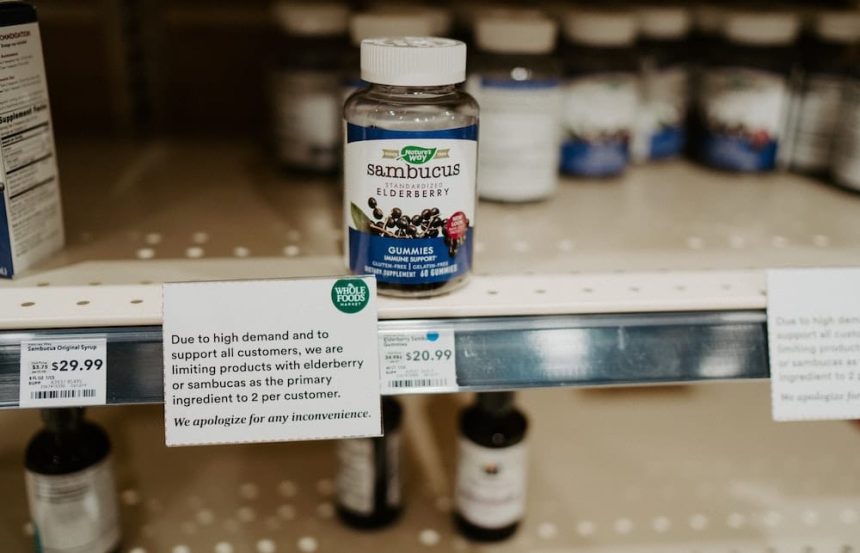

Star performers

Latest data finds that during the pandemic consumers have broadly retained the values that have fuelled growth in the natural and organic industry. Some categories in particular have performed especially strongly during the crisis. Sales of cold, flu and immune function focused supplements are set to grow by 51% in 2020 to be worth $52 billion. Plant-based protein sales have continued to surge during 2020, and of those consumers who tried plant-based meat for the first time during the pandemic 72% report they will repeat the experience.

Diversity deficit

As the pandemic has brought into sharp focus troubling inequalities facing minority groups, this presentation (drawing on data from J.E.D.I Collaborative) reveals striking disparities in our own industry. It shows that the natural and organic industry continues to “serve mostly white consumers”, with BIPOC (black, indigenous, Latinx, Asian and other people of colour) making up just 27% of the natural and organic consumer base. Commenting on this, McCoy said: “If you think about it, that’s either a 13% availability or economic gap”.

The industry itself is shown to lack diversity, particularly at leadership levels (84% of business leadership members are white, while 68% of board members are men). By contrast, increasing community diversity from America’s growing multicultural population is driving major trends for new product opportunities (for example, in new flavours, ingredients and cuisines. To maximise the “multicultural food opportunity”, industry is warned against cultural appropriation (a charge that has been levelled at some prominent natural and organic names), and urged to aim for authenticity and participation.

A time for bold moves

Mast and McCoy argue that “now is the time for bold moves”. Their presentation shows that the experience of living with Covid has made environmental health more important to consumers. At the same time, more US consumers are prioritising social equity and justice. This climate is helping “brands with genuine focus on actively and publicly addressing and correcting social injustices to add significant, tangible value”. As a result, more companies are adopting a new business model that applies the principle of the triple bottom line of profit, people and planet.

Spark Change is an initiative from Natural Products Expo, with a series of digital events and meetings scheduled in September, October and November 2020.

Spark Change is an initiative from Natural Products Expo, with a series of digital events and meetings scheduled in September, October and November 2020.

Main image: Brittani Burns on Unsplash